Bali Property Sales & Rental Market Insights 2025

Bali Property Sales Review 2025: Insights to Maximize Your Selling Strategy

Executive Summary

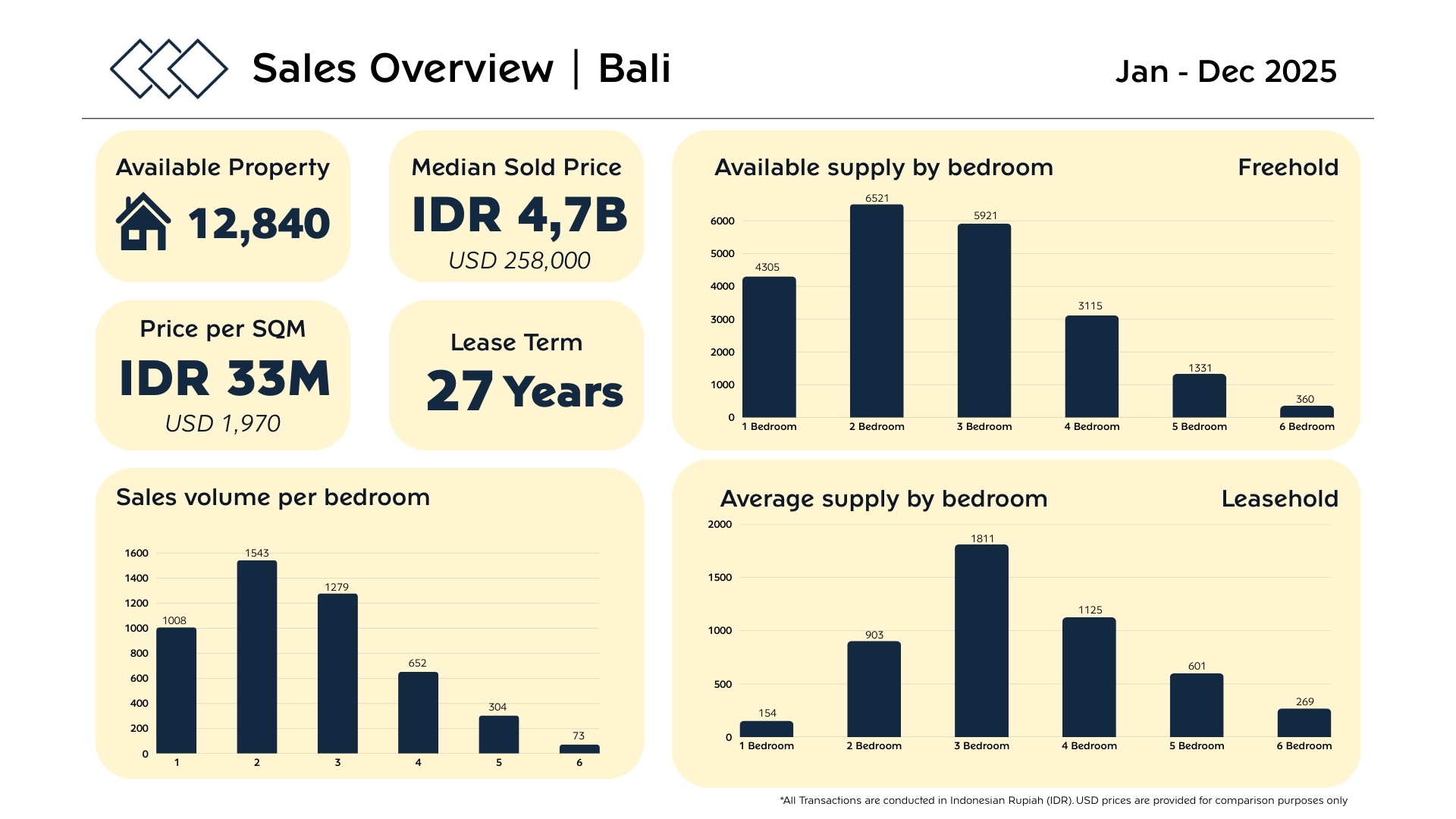

Bali’s 2025 sales market remained active with 12,840 listings. Median sold price reached IDR 4.7B (USD 258,000), while pricing averaged IDR 33M per SQM (USD 1,970). Lease terms stayed long at 27 years. Demand remained strongest in the 2–3 bedroom range.

How the Market Evolved from 2024 to 2025

-

Lease term held steady at 27 years.

-

Total sales volume slightly up: 4,798 → 4,859 (+1%).

-

2BR surged: 1,277 → 1,543 (+21%).

-

3BR stayed core: 1,283 → 1,279 (flat).

-

1BR softened: 1,122 → 1,008 (-10%).

- Bigger homes slowed: 4BR 698 → 652, 5BR 317 → 304, 6BR 101 → 73.

Market Overview

Sales Volume by Bedroom

Sales were led by 2-bedroom homes (1,543), followed by 3-bedroom (1,279) and 1-bedroom (1,008). Larger homes moved slower: 4BR 652, 5BR 304, and 6BR 73. This confirms the strongest liquidity in the mid-sized segments.

Supply Distribution

Freehold supply was highest in 2BR (6,521) and 3BR (5,921), followed by 1BR (4,305). Leasehold supply was concentrated in larger sizes, led by 3BR (1,811) and 4BR (1,125). Overall supply aligns with demand centered on 2–3BR.

Price and Lease Term

At IDR 33M per SQM, pricing remains competitive but buyers are value-driven and will negotiate based on condition, layout, and location. A 27-year average lease term supports stable deal structures and longer planning horizons for both lifestyle and investment buyers.

Strategic Recommendations for Sellers

To maximize results, lead your marketing with the most liquid segments: 2–3 bedroom homes typically attract the widest buyer pool. Compete on clarity by providing complete documentation, clean property presentation, and a simple “why this property” message. For 4–6 bedroom homes, sell the use case (family compound, premium lifestyle, group rental potential) and target the right audience rather than mass marketing. Strengthen buyer confidence with professional photography, accurate floor information, and visible maintenance quality—especially in crowded segments.

Conclusion

Bali’s 2025 sales market shows steady movement with demand concentrated in 1–3 bedroom homes, especially 2-bedroom properties. Sellers who align pricing with buyer expectations and clearly communicate value will perform best in a competitive environment. Strong presentation and targeted positioning remain critical to securing serious inquiries and closing deals efficiently.

Bali Annual Rental Market Review 2025: Key Insights for Smarter Leasing Decisions

Executive Summary

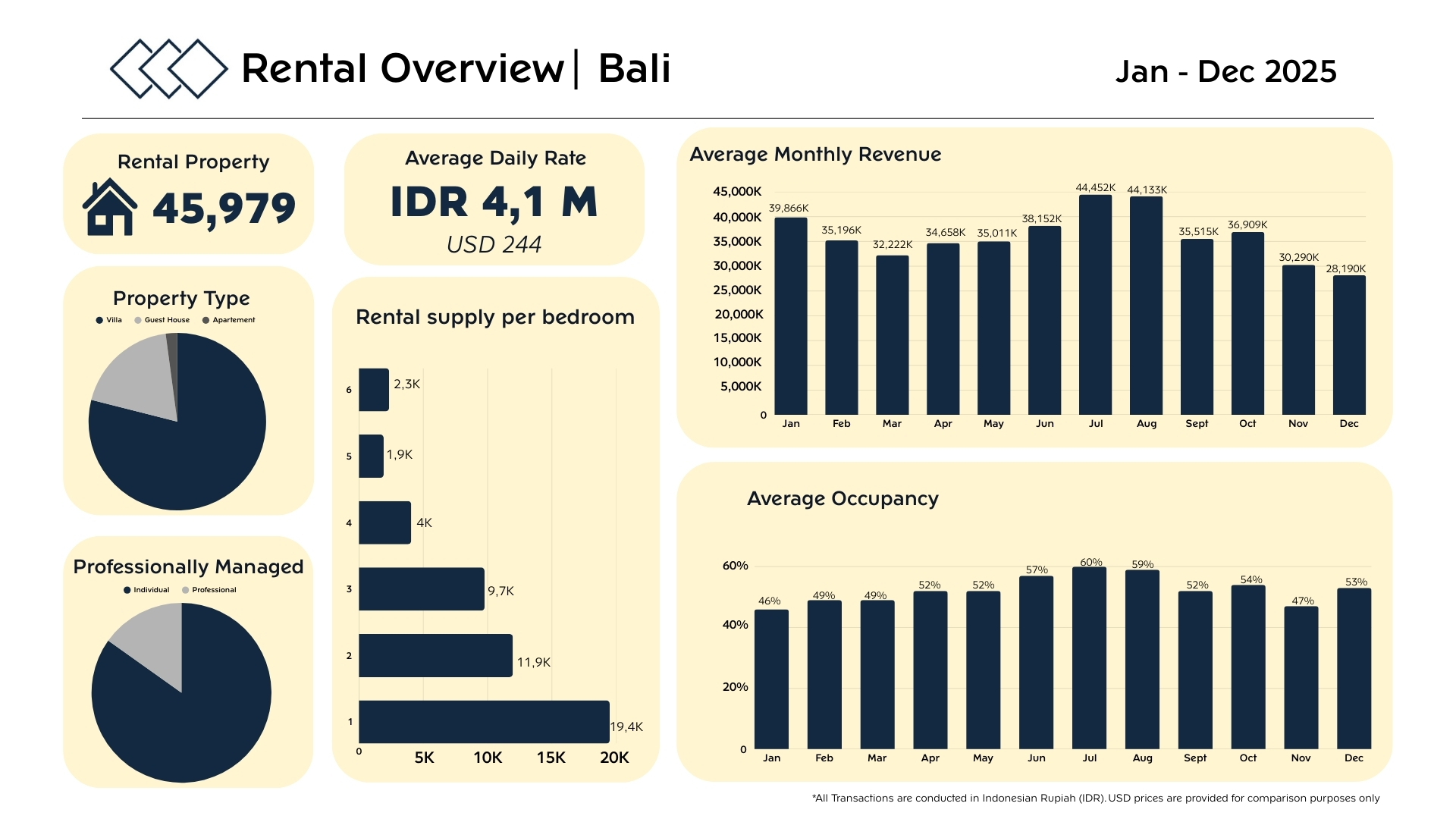

Bali’s 2025 rental market stayed seasonal, with mid-year peaks. The market recorded 45,979 active rental properties. Average daily rate was IDR 4.1M (USD 244). Revenue and occupancy moved in line with tourism demand across the year.

How the Market Evolved from 2024 to 2025

-

Seasonality unchanged: Jun–Aug remains peak.

-

Avg occupancy broadly stable: ~53.3% → ~52.5%.

-

Peak occupancy eased: ~62–63% → 60%.

-

Early-year demand improved: Jan 40.2% → 46%.

-

Net takeaway: rate pressure, stable occupancy—wins come from ADR + min-stay tuning.

Overall, 2025 shows rate pressure with stable occupancy, making ADR and stay-rule optimization key levers.

Rental Property Overview

Bali’s rental inventory totaled 45,979 properties in 2025. Demand remains broad across short- and mid-stay travelers, but performance is highly sensitive to value, reviews, and listing presentation, especially in competitive villa markets.

Revenue Trends

Monthly revenue peaked in July (IDR 44.5M) and August (IDR 44.1M), supported by June (IDR 38.2M). The softest months were December (IDR 28.2M) and November (IDR 30.3M). This highlights the importance of peak-season pricing and low-season protection.

Occupancy Analysis

Occupancy peaked in July (60%) and August (59%), with steady mid-year levels in June (57%). Lower months included January (46%) and November (47%), while December (53%) stayed active. Revenue gains depend on optimizing ADR and stay rules during high-demand periods.

Property Type Insights

Villas continue to represent the dominant rental product in Bali, matching traveler preferences for privacy, lifestyle experiences, and complete facilities. Alternative property types remain relevant for shorter stays and budget-driven guests, but competition in mainstream villa categories remains intense.

Management Strategy

Most listings are still managed by individual hosts, while professionally managed properties represent a smaller portion of the market. Professional operations can improve performance through stronger guest communication, consistent standards, better review management, and more effective rate adjustments during shoulder and low seasons.

Supply Distribution

Supply remained concentrated in smaller units, led by 1-bedroom, followed by 2-bedroom and 3-bedroom listings. Larger homes (4–6BR) make up a smaller share, suggesting a more niche segment that requires stronger differentiation and targeting.

Strategic Recommendations

-

Maximize peak season (June–August) with stronger ADR strategy, minimum stays, and a focus on higher-value booking patterns.

-

Use low season (Nov–Feb) to protect occupancy with weekly/monthly discounts, long-stay offers, and value-added packages.

-

Improve listing competitiveness: professional photos, clear amenities, and a strong “why stay here” message are essential.

-

For small units (1–2BR), differentiation matters most—design quality, location convenience, and guest experience can outperform price cuts.

- Consider structured management or professional support if you want more stable performance and smoother operations.

Conclusion

Bali’s 2025 rental market stayed healthy but highly seasonal. The strongest performance appears mid-year, while late-year and early-year periods require more tactical pricing and promotion. Owners who run data-driven strategies, balancing rates, occupancy, and guest experience, will be best positioned to improve rental profitability throughout the year.

Topic Categories

- All 359

- Uncategorized 6

- Bali Villa 28

- Bali Politics 6

- Bali News Update 7

- Bali Shopping 3

- Bali Tourism 49

- Bali Spirituality 2

- Bali Beauty and Fashion 0

- Bali History and Culture 23

- Bali Property Appraisal 1

- Bali Property Financing 3

- Bali Property Insurance 1

- Bali Property Management 5

- Bali Environment 11

- Bali Pets 2

- Bali Health and Wellness 17

- Invest in Bali 23

- Bali Local Services 6

- Bali Food & Dining 12

- Bali Home Improvement & Design 6

- Bali Legal Tips 7

- Bali Neighborhood Guides 11

- Bali Property Market Trends 15

- Bali Property Advice 60

- Bali Attractions 25

- FAQ 2

- Living in Bali 46

Topic Tags

- All 359

- Uncategorized 36

- Villa for sale Umalas 3

- Villa for sale Kerobokan 3

- Villa for sale Oberoi 3

- Villa for sale Pererenan 3

- Villa for sale Batu Bolong 3

- Villa for sale Berawa 3

- Villa for sale Sanur 3

- Villa for sale Seminyak 3

- villa for sale Ungasan 3

- villa for sale Jimbaran 3

- villa for sale Nusa Dua 3

- villa for sale Pandawa 3

- Kerobokan 3

- Bali market report 2

- Villa for sale Canggu 5

- Villa for sale Uluwatu 5

- Bali Rentals 2

- Buying Process 6

- Labuan Bajo 0

- Bali Hospital 3

- Bali School 3

- Bali Beach 12

- Co-working Space 4

- Petitenget 3

- Australia 0

- China 2

- Bali Wedding 1

- Bali Flights 4

- Retire in Bali 5

- Nyepi 2

- Bali Villa Sale 20

- Bali Visa 4

- Bali Travel 28

- Villa Rental 9

- Airbnb 0

- PT PMA 3

- Bali Zoning Law 1

- Bali Tax 3

- Bali Property 52

- Double Six 0

- Sunset Road 0

- Nyanyi 3

- Legian 4

- Beach Club 6

- Oberoi 3

- Batu Bolong 4

- Batu Belig 3

- Business 3

- Legal 10

- Investment 39

- Tourism 65

- Travel 24

- Jimbaran 8

- Denpasar 2

- Seseh 5

- Eid al Adha 1

- Ascension Day 0

- Easter 0

- Vesak 0

- Islamic New Year 0

- Eid al-Fitr 1

- International Labor Day 0

- Independence Day 2

- Day of Silence 0

- Galungan Day 1

- Valentine 2

- Christmas 5

- New Year 4

- Lunar New Year 2

- Bali Market Trends 12

- Bali Art & Culture 18

- Bali Home Design 9

- Bali Health & Wellness 18

- Bali Food and Dining 15

- Bali Pets 3

- Bali Lifestyle 43

- Rice Field Front 1

- Jungle View 1

- River Front 0

- Rice Field View 6

- Ocean View 4

- Private Pool 0

- Fix and Flip 1

- Fixer-Upper 0

- Hotel & Resort 3

- Guest House 0

- Street Front 0

- Residential Zone 0

- Touristic Zoning 0

- Freehold 4

- Long Lease 7

- Short-Term 1

- Minimalist Villa 0

- Luxury Villa 13

- Turnkey Villa 3

- Residential Complex 0

- Exclusive Listing 1

- Off-Plan Property 4

- Studio 0

- Loft 0

- Apartment 8

- Villa 16

- Land 6

- Beachfront 4

- Family Villa 0

- Retirement Villa 1

- Investment Villa 31

- Digital Nomad 2

- Commercial Property 3

- Eco-friendly 0

- Contemporary Style 0

- Modern Style 1

- Javanese Style 0

- Rustic Style 0

- Traditional Style 0

- Bohemian Style 0

- Mediterranean Style 1

- Balinese style 1

- Nusa Penida 3

- Lombok 1

- Gili Island 3

- Amed 2

- Tabanan 9

- Cemagi 4

- Nusa Dua 9

- Sanur 7

- Umalas 7

- Berawa 6

- Ubud 12

- Tanah Lot 3

- Kuta 8

- Pererenan 6

- Uluwatu/Bukit Peninsula 33

- Seminyak 13

- Canggu 38

Relevant Articles you may like

Map

Send an Enquiry

Property Search

Sell/Rent My Property

Please fill this form and our listing agents will contact you to visit your property and/or give you a price valuation